Emerging Markets Online | Author: William Thurmond

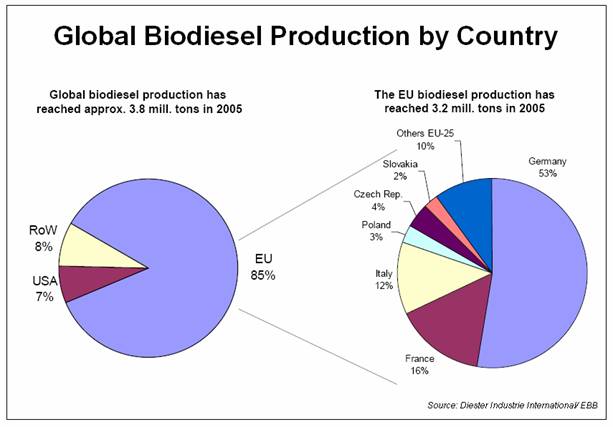

A new study from Emerging Markets Online titled Biodiesel 2020: A Global Market Survey finds the global market for biodiesel is poised for explosive growth in the next ten years. Although Europe currently represents 90% of global biodiesel consumption and production, the U.S. is now ramping up production at a faster rate than Europe, and Brazil is expected to surpass U.S. and European biodiesel production by the year 2015. India and China also have massive plans for biodiesel development over the next two decades.

It is possible that Biodiesel could represent as much as 20% of all on-road diesel used in Brazil, Europe, China and India by the year 2020. If governments continue to aggressively pursue targets; enact investor-friendly tax incentives for production and blending; and help to promote research & development in new biodiesel feedstocks such as algae biodiesel, the prospects for biodiesel may become realized faster than anticipated

By the year 2020, the global population is expected to grow from 6 billion in 2006 to over 8 billion. From 2006 to 2020 the global energy market is expected to grow, on average, at about 1.5%, ranging from 1.3% to 1.7% depending on which energy expert, government forecast, or think tank report you read. The U.S. energy market is expected to grow at 1.7% per year to 2020, Europe at 1.3% per year, China at approximately 4% a year (ranging from estimates of 3.8% to 8% per year to 2020), India at 3% and Brazil at approximately 3% to 4% per year.

Source: Emerging Markets Online, Biodiesel 2020: A Global Market Survey

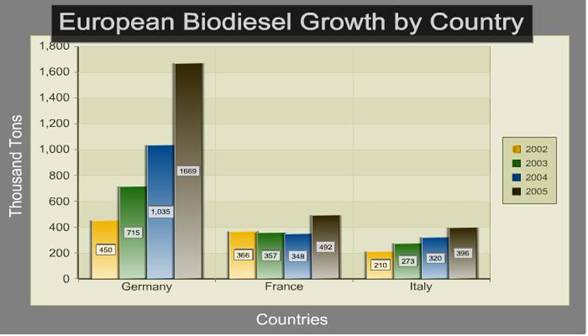

Currently Europe is the biggest biodiesel market in the world, accounting for over 90% of all biodiesel consumed and produced, according to the European Biodiesel Board. The U.S. biodiesel market is already working hard and at fast at changing this number. In 2005, Europe consumed over 900 million gallons of biodiesel. In the same year, the U.S. consumed 75 million gallons of biodiesel. For Europe, 900 million gallons only represents 2% of all on-road transportation. In the U.S., 75 million gallons represents about ½ of 1% of all diesel consumed on-road.

While the U.S. market for biodiesel has enormous potential, it is still a nascent market. The biodiesel market in the U.S. represents less than one percent of the total U.S. supply of diesel fuel. This figure is estimated by most experts to currently be at about .002%, or two tenths of one percent of the total diesel consumption. While Europe's market for biodiesel stands at 2% of total supply, the U.S. biodiesel market remains at less than 1%. Although biodiesel has not yet made a major impact on the U.S.' diesel fuel sector, changes are afoot in the industry.

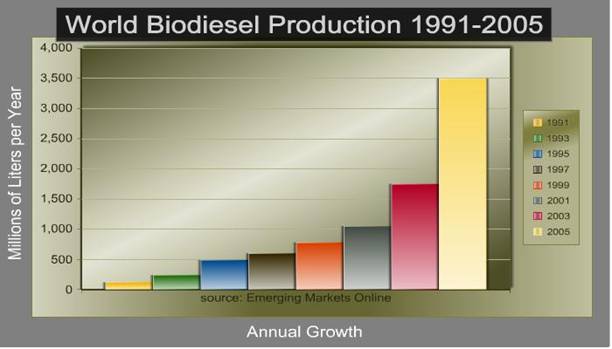

In the last three years, the U.S. market has become an "Emerging Market" for biodiesel. The story of this meteoric rise in market growth speaks volumes to the major strides in the production and distribution of biodiesel in recent years. How has this happened? In 2004, 70 million gallons of biodiesel were produced in the U.S. In 2005, this amount grew to over threefold to 240 million gallons of biodiesel produced in the U.S. By the end of 2006, this figure is expected to grow fourfold to reach over one billion gallons of biodiesel produced per year.

In Europe and in the U.S., the markets have a ways to grow to reach their targets aimed at replacing some percentage of imported petroleum fuels with biofuels. Europe's first target, 2% by 2005, was reached by the end of 2005. Europe's next targets, 5.75 by 2010 and 20% by 2020 may or may not be achievable depending on feedstock availability, government commitment, and market economics. Using current consumption figures, Europe's 5.75% target by 2010 equals approximately three billion gallons, and 20% is approximately 20 billion gallons. In the U.S market, biodiesel and ethanol are mandated under the U.S. Renewable Energy Standard. In the U.S. market, only 3% of all cars on the road run on diesel, and over 80% of all commercial trucks and major bus networks in municipal areas run on diesel.

Source: Emerging Markets Online, Biodiesel 2020: A Global Market Survey

Ethanol in the U.S. is expected to address the other 97% of the U.S. consumer automotive market. Currently, biodiesel's first task in the U.S. is to replace fuels used in school buses, metro buses, 18 wheelers, and large commercial vehicles. There is a relatively small U.S. market for diesel in passenger cars compared to Europe (over 50% of all cars run on diesel), China, India and Brazil where diesel is the dominant on-road fuel for passenger cars. The U.S. market share of diesel cars is expected to grow from 3% in 2005 to 11% by the year 2010. Until then, there is a very large market for commercial vehicles, trucks and buses in the U.S. to be addressed by biodiesel.

Source: Emerging Markets Online, Biodiesel 2020: A Global Market Survey

In some of the “emerging markets” in the developing world, the potential for biodiesel growth in China, India and Brazil is enormous. In the investment community, these have long been known as the “Big Emerging Markets” representing over 50% of the world’s population. These three countries also represent some of the fasting-growing middle class populations and regional economies in the world. In addition, over the last five years, these three countries represent three fourths of the largest growing “foreign” market segment outside the U.S. known as “BRIC” – Brazil, Russia, India and China. The BIC portion of BRIC is the ripest climate for Biodiesel growth outside the U.S. In each of the BIC countries, massive government measures are being enacted to institute Biodiesel as a part of the country’s long-term energy infrastructure and as a supplement to the increasingly risky supply of oil from antagonistic regimes and OPEC cartel members from the Middle East, Africa, Venezuela, and Russia.

Brazil, China and India are just getting started with their biodiesel development plans. Their markets are in their infancy and are just starting to grow. In each of these countries, there is not yet any large-scale biodiesel production, but there are large-scale plans underway by the governments to use biodiesel in a big way. Each of these countries has established a "National Biodiesel Plan" with mandates and targets aimed at reducing import dependency on petroleum products with biodiesel and ethanol. These National Biodiesel Plans are designed to replace fuels that release carbon-emissions such as diesel fuel and gasoline used by consumers and commercial vehicles. In every case, for India, Brazil and China, the targets and programs are ambitious but achievable, given the right variables and levels of commitment.

What will the Biodiesel Market look like in the year 2020? Based on the findings of our report, Biodiesel 2020, it is clear that the period of 2010 to 2015 will experience significant growth in the U.S., Europe, China and Brazil. Another key observation: it is significant to note that most of the biofuels targeted by the U.S., Brazil and India are for blending purposes and not strictly for B100 use. It seems unlikely that most of the world will use B100 as a first choice for biodiesel fuel for autos. Instead, most nations are now following the "blending" model used by the U.S. and France for B2, B5 and B20. Brazil, China and India are also following this route forward and are starting their National Biodiesel Plans with blending targets first.

By the year 2015, as energy demands for soybean, canola and Jatropha oil surpass the available land to plant these energy-rich crops, alternative feedstocks such as palm oil and algae-based biodiesel will help to meet these growing demands. The U.S. National Renewable Energy Lab forecasts that soybean and canola based biodiesel will only be able to supply 10% of the total market for energy needs in the U.S. However, new feedstocks such as algae-based biodiesel will go into mass production in the U.S. and be able to provide 30% or more of all transportation-based energy needs from biodiesel by the year 2020.

One of the most promising alternative biodiesel feedstocks is algae. Algae-based biodiesel has the opportunity to produce more than 10 times the amount of oil per acre than soybeans or canola can produce. By the year 2020, if Europe, the U.S., Brazil, China and India reach their first or second targets, and replace between 5% and 10% of automotive fuels on the road with biofuels, the need for alternative biodiesel feedstocks will emerge. It is likely that algae-based biodiesel and other new feedstocks will help to meet future biodiesel growth needs at significantly lower production costs.

Biodiesel 2020 Study - More Information

Biodiesel 2020: A Global Market Survey is designed to help financiers, producers, developers, distributors, consultants and analysts with a fact-filled market guide detailing medium and long-term trends and developments in the Biodiesel sector. This study focuses on market fundamentals, emerging market trends, long term forecasts and scenarios, and case studies of existing and up and coming biodiesel producers and distributors.

http://www.emerging-markets.com/biodiesel

William Thurmond

Author, Biodiesel 2020: A Global Market Survey

http://www.emerging-markets.com/biodiesel/default.asp

Managing Director, Emerging Markets Online

http://www.emerging-markets.com

Contact Info:

Author, Biodiesel 2020: A Global Market Survey

http://www.emerging-markets.com/biodiesel/default.asp